In 1980, Harshad Mehta, a young boy, stepped into the Bombay Stock Exchange for the first time, unaware that he was destined to rise from a regular jobber to become the “Big Bull” of the Indian stock market. This is the story of India’s biggest scandal. In 1973, 18-year-old Harshad Mehta was living in Raipur, feeling disappointed with his life. His father’s business and health were deteriorating, but Harshad was determined to change their situation. Let’s explore insights from “Harshad Mehta Scam 1992” in the Indian Stock Market.

Seeking a fresh start, he moved to Mumbai, a city that would soon transform his life. He enrolled at Lala Lajpat Rai College and took up various side jobs, collecting plastic scrap to sell and even trading cement. Sometimes, he would carry and deliver the cement to save money. Within a few years, Harshad’s family joined him in Mumbai. In 1977 after graduating, Harshad started working at New India Assurance Company with a salary of 6,600 INR. His brother, Ashwin Mehta, also worked, securing a job at ICICI. Alongside their jobs, they both pursued side businesses. However, after two years of effort, they couldn’t achieve the hoped-for success. Determined to try something new, they decided to test their luck in the stock market. How the stock market was about to turn Harshad’s life and mark it identity as “Harshad Mehta Scam 1992”.

Insider Trading & Pump And Dump Technique

At that time, the Bombay Stock Exchange (BSE) had a trading ring where shares were bought and sold manually, as electronic trading hadn’t yet been introduced. Only jobbers and brokers could enter this trading ring. Jobbers were responsible for buying and selling shares on behalf of their clients. Harshad decided he wanted to make trades for himself, and for that, he needed to become a jobber. He approached a broker named P. Ambalal and repeatedly requested to become a jobber. After several attempts, he finally earned his jobber’s badge.

On his first day as a jobber, Harshad faced a hectic start, incurring a loss of 2,000 INR. Instead of feeling discouraged, he took it as a learning experience and focused on upgrading his skills. Within months, he became one of the most skilled jobbers in the market. He realized that to succeed, he needed access to inside information about companies. To gain this edge, he began networking with people who could provide him with valuable insights. He established connections with labor unions to receive updates on daily production data. This allowed him to buy shares when production was high and sell immediately if production slowed or if there were labor strikes. This strategy, known as insider trading, became an integral part of his approach.

As a jobber, Harshad traded for clients and invested his own money in the stock market. By 1982, leveraging insider trading, he had accumulated substantial wealth. Beyond insider trading, he experimented with a new strategy called “pump and dump.” In this approach, he and his associates would identify undervalued or inactive stocks, buy large quantities to reduce market supply and drive up prices. Harshad would then gradually sell off portions of his holdings, making significant profits as the price surged. His earnings grew rapidly with these tactics, and he became confident that he was unbeatable in the market. However, this success laid the foundation for a major turning point—one that would become known as the “Harshad Mehta Scam 1992.”

Harshad’s Success with Growmore Consultants

It was a Black Thursday on March 18, 1982. The stock market opened, and by 2 p.m., it was crashing. As everyone watched the crash unfold, panic selling erupted, and within 15 minutes, the market experienced one of its fastest declines. Harshad faced a loss of 10 lakh and was devastated. To repay brokers, he had to pawn his wife’s jewelry. For a while, Ashwin’s wife, a freelance beautician, took over the household expenses.

In June 1982, Harshad and Ashwin decided to re-enter the market. They launched their own stock firm, Growmore Consultants, to offer stock market consulting services. The objective of Growmore was to manage portfolios for wealthy clients, investing their surplus funds to generate high returns. Ashwin’s father-in-law contributed 4 lakh, and their accountant provided an additional 1 lakh, allowing Growmore’s operations to begin.

Harshad noticed that tea leaf prices had risen by 3-4 INR, indicating upcoming profits, yet tea stocks remained undervalued. He bought shares of companies like McLeod Russel and Tata Tea in large quantities. Within a few years, these stocks soared, bringing substantial profits to Harshad and Growmore’s clients. The high returns helped Growmore Consultants gain popularity, attracting significant investments into its schemes. By 1985, Harshad’s demand and reputation were soaring

Role of ‘Manu Manek’ in Harshad Mehta Scam 1992

But there was a personality, Manu Manek, who was unhappy with Harshad Mehta’s success. He was an old player in the market and a “bear” in stock market language. He earned through short selling, a strategy in which shares are borrowed to sell at a high price and bought back when the price falls, making a profit from the price difference. Manu Manek profited when share prices fell. He had been waiting for an opportunity to beat Harshad Mehta for a long time, and he got that chance in 1986.

Finance Minister V.P. Singh made decisions in the budget announcement that were not favorable for business, causing the stock market to fall rapidly. Harshad had bought SPIC shares in large quantities, and even their prices were dropping. Manu Manek and his associates conducted heavy short selling, driving down SPIC’s price. Harshad had invested in SPIC on margin from the BSE. Rumors began to spread that Harshad had a loss of 1 crore and could not cover his dues. Essentially, news spread across the market that Harshad and Growmore Consultants were about to go bankrupt.

In reality, Harshad had sufficient funds to pay his dues. To save himself and Growmore, he needed to act, as they typically had 14 days to return dues. He decided that the best way to silence the rumors was to pay early. He cleared all payments in advance, boosting his reputation further, and the bears were shocked. This decision resulted in a loss of 1.5 crore for Harshad, a significant hit, but he managed to bounce back quickly.

The Money Market : Major Role in Harshad Mehta Scam 1992

Growmore began working with institutional investors alongside smaller investors, and soon Harshad became one of the biggest brokers in the market. However, he faced a dilemma; he no longer wanted to simply earn broker fees—he wanted to be an investor himself, where both the money and profits would be his. To achieve this, he needed to generate hundreds of crores in profit.

Harshad then decided to enter the money market, a system where banks provided short-term loans to each other, typically for a 15-day period. This move marked his shift toward larger-scale financial strategies, setting the stage for his ambitious plans in the financial world.

Harshad noticed that players like Citibank, Ajay Kayan, and Hemendra Kothari operated a cartel that controlled the market, preventing new brokers from entering. Recognizing this barrier, Harshad identified banks dissatisfied with the cartel’s dominance and offered them his broking services. Through these alliances, he formed his own network and, within two years, rose to become a top broker in the money market, earning substantial income from brokerage fees.

Loop Holes in the Money Market System

To save time in the money market, many banks would deposit advance funds into broker accounts so brokers could act quickly on the best deals by transferring money to other banks in exchange for a Bank Receipt (BR). Harshad observed loopholes in this process. He noticed that when banks paid advances, this money remained idle until a deal occurred. Seeing an opportunity, Harshad decided to use this advance money to invest in the stock market, artificially inflating the prices of his favorite stocks. When it came time to finalize the deal, he would sell the shares, pocket the profits, and transfer the required funds to the next bank. No one knew this was about to make history as “Harshad Mehta Scam 1992”.

The next loophole Harshad identified was the lack of verification for fake Bank Receipts (BRs). Acting on this, he bribed smaller banks, like the Bank of Karad, to issue fake BRs. Harshad would take out loans from major banks, invest the funds directly into the stock market, and provide the banks with these fake BRs as collateral. This strategy gave him substantial cash flow for stock market investments.

By 1992, Harshad had driven the market to new heights. His success allowed him to purchase a lavish 15,000 sq. ft. penthouse, 29 cars, including luxury models, and earned him the title “The Big Bull.” He was in high demand, featured in magazines like Business Today and Business India.

Harshad Mehta Scam 1992 Revealed

In 1991, the RBI received a tip that BRs were being misused in the money market, prompting them to inquire into certain banks and issue strict guidelines on BRs. Operating with fake BRs became much more difficult. That same year, Harshad took a 500-crore loan from SBI but was unable to provide a fake BR to cover it. To bypass this, he bribed an SBI employee to manipulate the records.

In 1992, however, SBI officials discovered the 500-crore gap and confronted Harshad, pressuring him to repay the amount. Ashwin suggested selling stocks to cover the debt, but Harshad resisted, hoping to avoid capital gains tax. Instead, he took a loan from NHPC to pay SBI through investments.

Journalist Sucheta Dalal from The Times of India uncovered the scheme and, on April 23, 1992, published an exposé on the 500-crore irregularity. In response, SBI demanded that brokers square up, and the revelation led to outcry in Parliament, where the government faced criticism. The Income Tax Department, RBI, and CBI launched multiple investigations into Harshad’s activities. Gradually, both the money market and stock market scandals unfolded, and the entire country became aware of the “Harshad Mehta Scam 1992.”

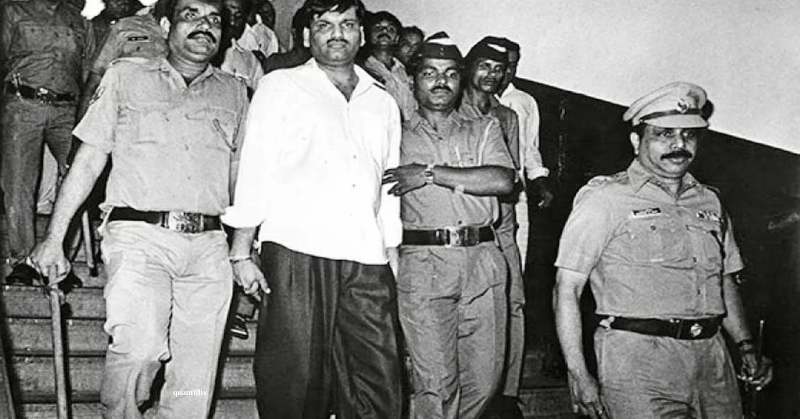

On June 4, Harshad and Ashwin Mehta were arrested, and all assets were seized. Tragically, Harshad passed away in police custody in 2001 at the age of 41.